Product managers are often seen juggling between engineering, design, analytics and marketing. But a FinTech product manager has to go the extra mile in order to collaborate with other stakeholders like compliance, legal, accounting, fraud/credit risk and many more.

That’s a real challenge - the ability to communicate and appease all stakeholders to work towards creating one homogenous product.

Building trust and improving velocity with cross-functional teams helped Praveen, a fintech product manager, increase loan application submissions at Moneyview by 15%.

We spoke to Praveen, PM at Moneyview and a Mentor with Upraised to find out how.

Let’s start by understanding - what does Moneyview do?

Money View is a fintech startup primarily focusing on giving out instant personal loans to people with minimal documentation.

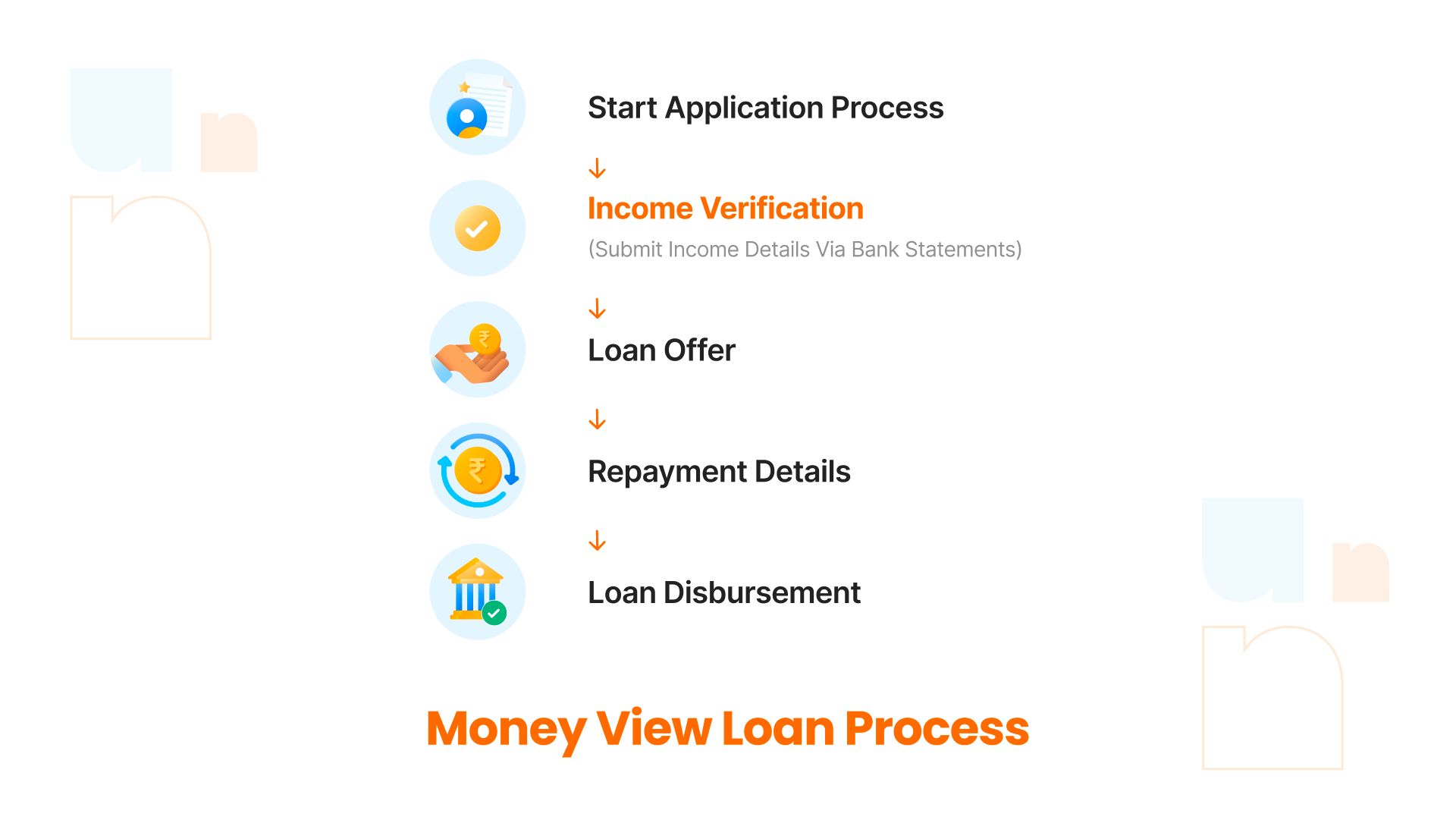

There are some simple steps involved:

On the Money View app, a customer can fill out an application—with details such as their credit score, income, and age—and check their eligibility for a loan within minutes.

They can then upload necessary documents to verify their income, select the duration of repayment and the amount borrowed is disbursed into their bank account within 24 hours.

The income verification step is one of the most critical steps in the loan disbursement process for Moneyview. Bank statements of the users are used to validate the creditworthiness of the user.

This was also the point where Moneyview saw the majority of its users drop off.

The task at hand was simple - decrease the drop-off rate to increase the number of loan applications.

Before finding a solution, Praveen had to find the answer to one simple question - why were the users dropping off when asked to submit bank statements?

Around 70% of moneyview’s users came from tier two and tier three cities having Public Sector Banks.

Upon some research, they found that:

👉Not all Public Sector Banks share statements digitally

👉Users were not aware of the net banking options available to them.

👉This resulted in a lot of manual work. A user had to physically go to the bank to get their statement.

The real problem: Bank Dependency

How did they solve this problem?

They solved this problem by using the ‘Account Aggregator (AA)’’.

An Account Aggregator is an RBI-regulated entity that helps an individual access and share information from one financial institution they have an account with to any other regulated financial institution.

All secure and digital!

Now all a user had to do was create an aggregator account, give Moneyview the required consent and get all documentation sorted on their behalf.

What impact did this feature have?

This simple solution gave Moneyview a 15% jump in the number of application submissions and immensely helped us in improving the platform.

While the solution seems simple and easy - the road leading to the successful implementation of this feature was as bumpy as it could get. Praveen’s ability to keep all stakeholders motivated was the real reason behind the success of this idea.

"As a PM it was my responsibility to potray a bigger picture to all the stakeholders involved and keep them excited at all times".

Praveen’s responsibility as a PM was to maximize the product’s value. He ensured he set up a healthy environment by influencing stakeholders towards taking action and making decisions.

Praveen understood that the makers of the product are not the users hence it was very important for him to tell the team why they are doing what they are doing and what's in it for them. Knowing what personally motivates the team allowed him to understand how to help them be more productive.

What’s our key takeaway from this case study?

👉Product Management is not just about building great products or features.

👉 Collaborating with different stakeholders and keeping them excited at all points is a major challenge for any PM.

👉 As a product manager your key responsibility is to ensure maximum productivity by telling your team members the “why” behind whatever they are working on.

Thank you for reading keep following for more such interesting case studies!